Bethel Digital Therapeutics

The Operating System for Pediatric Care.

The Care Gap

Digital Care is the only scalable bridge.

The Bethel OS Architecture

One Platform. Three Integrated Layers.

Layer 1: The Clinical Core

Proprietary R&D Engine

Led by Dr. Lucy Liu & 10+ global experts.

The Trust Barrier

Engine 1: TALK 3D - The Core System

Language, Social & Communication Development

TALK 3D: Unit Economics

Monetizing the 'Hospital Halo Effect'

Zero-Cost Credibility: Clinics buy us because Hospitals use us.

TALK 3D: Financial Scale

Clinical trust converts into distributor-led compounding revenue.

2026

2027

2028

2029

2030

6.1x projected revenue expansion from 2026 to 2030.

Steady, recurring revenue compounds as the installed base deepens.

Engine 2: DREAMOLIA® - AI Storybook

Precision Neurodevelopmental Intervention

Toy-Based Pedagogy

Transforms the child's real-world toy into a digital hero to anchor attention (ADHD specific).

Parental Voice Clone

Uses 'Parentese' prosody to deliver therapy in the parent's voice, reinforcing emotional safety.

Dynamic Text (DTP)

Reduces 'visual crowding' for dyslexic readers by highlighting text in sync with audio.

Generative Social Grammar

Teaches complex social interactions and 'Theory of Mind' through personalized storytelling.

DREAMOLIA®: Precision vs Generic AI

Why clinical guardrails outperform raw generation

Generic AI

Broad and shallow outputs

Higher hallucination risk

No pathology-specific guidance

Unsafe for therapy-critical decisions.

Bethel AI

Pathology-specific response shaping

Clinical Logic Layer validation

Therapeutically aligned output

Built for real-world pediatric intervention.

Every generated intervention is filtered through clinical guardrails before delivery.

We sell safety, not just generation.

Valuing DREAMOLIA®

Benchmarking DREAMOLIA® against engagement + wellness leaders

DREAMOLIA® combines Duolingo-grade engagement with Calm-like health monetization.

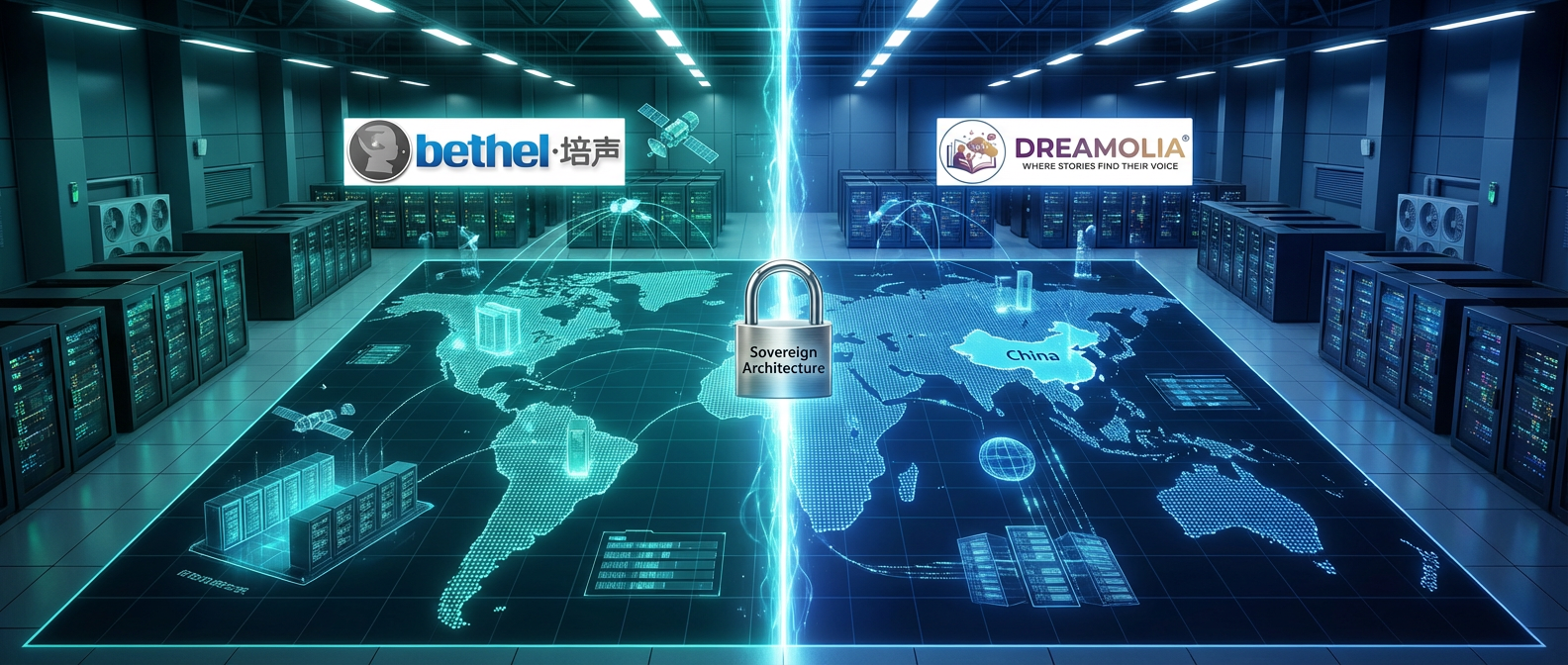

Compliance & Security Architecture

Dual-Stack Isolation

Global Stack

AWS + US LLMs (Global Data)

China Stack

AliCloud + Local LLMs (Domestic Data)

Zero Cross-Border Personal Identifiable Information (PII) Transfer

Engine 3: Floreo VR Partnership

Exclusive China Joint Venture

Localizing the world’s leading VR behavioral therapy for immediate clinical deployment.

Pico Localization

Port Floreo’s Unity therapy stack to China-native Pico hardware.

Hainan Green Channel

Medical Pilot Zone allowing fast-track import, bypassing multi-year approval cycles.

Hospital Distribution

Leverage Bethel’s existing Tier-3A network for rapid rollout.

FDA Breakthrough Device

Leverage global accreditation for local authority.

Not reseller economics: exclusive JV control + local execution advantage.

Revenue Expansion: $24K Per Clinic

Land once at $6K, then stack three module expansions to compound revenue.

Deployment Base

COTS (Commercial Off-The-Shelf)

Standard iPad & Pico VR

Proprietary Kiosk Mode (MDM)

Zero Manufacturing Risk

Unit Economics Expansion

4x Revenue expansion from one installed clinic relationship.

Per Clinic Annual Revenue

Land + Expand Sequence

Land: Core Bethel DREAM®

Anchor subscription

Expand 1: TALK-3D Home Data-Sync iPads

Data continuity upsell

Expand 2: DREAMOLIA® AI Storybook

High-margin parent module

Expand 3: Floreo VR

JV revenue-share upside

4x Revenue expansion from one installed clinic relationship.

Total Revenue Potential (2026-2030)

One installed base, four product streams, compounding year by year.

$1.94M

2026

$4.35M

2027

$8.43M

2028

$13.8M

2029

$21.2M

2030

Bethel OS

TALK-3D

DREAMOLIA®

FloreoVR

2030 Total Revenue

Revenue scales from $1.94M (2026) to $21.18M (2030), a 10.9x expansion.

Growth is driven by additional services on the same clinical footprint.

World-Class Team

Our team bridges the gap between Western science and Chinese practice.

BCBA & CCC-SLPs: Full-time, US-certified experts on staff.

Linguists: Experts in Mandarin language acquisition nuances.

Verifiable Recognition:

- ASHA Centennial Session Presenters

- Published authors (Textbooks/SCI Publications)

- University of Texas at Dallas (UTD)

Clinical DNA + Tech Scale

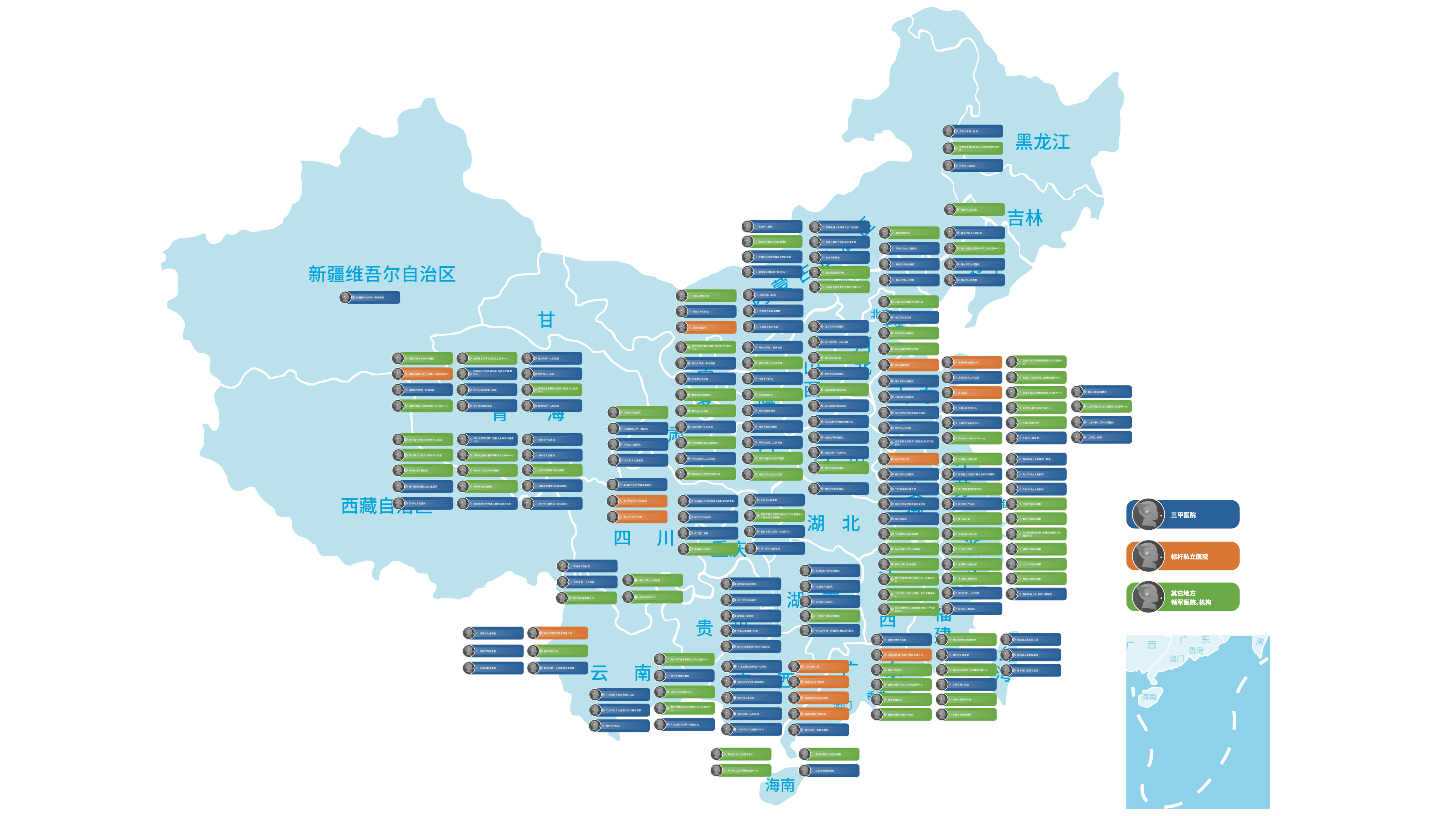

Bethel’s established network already spans 300 top Tier-3A hospitals across China.

Return on Investment: The 2030 Case

Safety in Domestic Core + Upside in Global Scale

Value: TALK 3D (Domestic Core)

$0MValue: AI Storybook (Global)

$0MValue: Floreo JV (Import)

$0M

Our Commitment: Skin in the Game

We put Shareholders and Investors BEFORE ourselves.

We invest $1 of personal capital for every $2 of outside capital.

In a downside scenario, Founder Common Stock is liquidated *before* Investor Preferred Stock.

We will NOT cash out until AFTER all investors who want to exit have successfully exited.

Radical Founder-Investor Alignment. We are not here to play startup. We are here to build a legacy.

If this aligns with your investment mandate, I welcome a direct note.